These resources have economic value and are expected to provide future benefits. These can include cash, inventory, equipment, buildings, and investments. Want to turn your accounting into a powerfull business management tool? Consider integrating it with all your sales sources and payment systems to create a single source of truth about your business finances. Book your seat at our free Weekly Webinar of try Synder for free to see how it can help you manage your business more efficiently.

Our Services

Non-profits’ COAs differentiate between various funding sources, donations, program-related expenses, administrative costs, and fundraising efforts. Segregation of accounts is crucial to demonstrate fiscal responsibility to donors and regulatory bodies. Develop a systematic numbering system and structure for accounts to facilitate organization and ease of use. This numbering convention typically follows a hierarchical structure, with each account having a unique code. The structure should allow for scalability and flexibility to accommodate future expansions or changes.

Can a chart of accounts be customized to fit specific business needs?

Common equity accounts include owner’s equity, retained earnings, and capital contributions. Equity accounts signify the ownership stake and measure a company’s net worth. In retail, COAs often segregate accounts for inventory, sales, cost of goods sold (COGS), and various expense categories. For instance, a retail Chart of Accounts might have detailed sub-accounts for different product lines or departments. It helps track sales revenues, inventory levels, and specific expenses like advertising, rent, or utilities. If the business offers manufacturing services to others, a separate revenue account, Manufacturing services, is included to track income from these services.

Numbering and Structure:

It helps everyone in the company know exactly where the money is coming from and where it’s going. Revenue appears at the top line of the income statement, showing the total amount of money earned from sales or other business activities. It reflects the company’s ability to generate income from its core operations, indicating its financial health and growth potential.

Chart of Accounts: Definition, Guide and Examples

Expenses are the means a company spends to generate revenue and operate its business. They can be the money spent on resources and activities necessary to keep the business running smoothly. The revenue accounts appear based on the source of where the income comes from. Liabilities are the amounts of money a company owes to others or the obligations it needs to fulfill in the future. Think of debts to suppliers, loans from banks, or unpaid expenses – they are your liabilities.

- Have you ever thought about how businesses handle their accounts and finances efficiently?

- Here are tips for how to do this, plus details about what a COA is, examples of a COA and more.

- In this guide, we’ll walk you through the ins and outs of the Chart of Accounts (COA) and provide real-world examples to illustrate its significance.

- We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

- Think of debts to suppliers, loans from banks, or unpaid expenses – they are your liabilities.

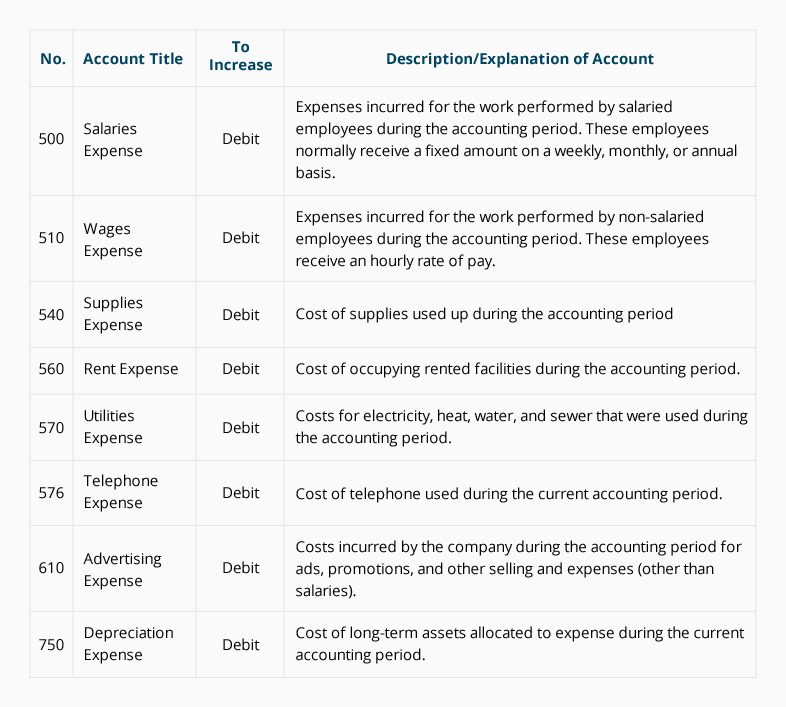

Example of an account numbering system:

If you keep your COA format the same over time, it will be easier to compare results through several years’ worth of information. This acts as a company financial health report that is useful not only to business owner, but xero integration with quote roller also investors and shareholders. Accounting systems have a general ledger where you record your accounts to help balance your books. Keeping your accounts in place and up-to-date is important for analyzing your finances.

Think about the chart of accounts as the foundation of a building, in the chart of accounts you decide how your transactions are categorized and reported in your financial statements. Therefore, when crafting a chart of accounts, always consider the tax legislation, financial reporting standards, government regulations and other compliance requirements relevant in your circumstances. For example, a well-designed chart of accounts makes it easy for bookkeepers and accountants to figure out which financial transactions should be recorded into which general ledger account.

It is basically a listing of all the accounts found in the general ledger that the business will use to code each bookkeeping transaction. This sample chart of accounts provides an example using some of the most commonly found account names. Asset accounts consist of tangible and intangible resources owned by a business. These can include cash, accounts receivable, inventory, property, equipment, investments, and intellectual property. Asset accounts are crucial in determining a company’s financial health and its ability to meet short- and long-term obligations.

A chart of accounts gives you great insight into your business’s revenue beyond just telling you how much money you earn. It shows peaks and valleys in your income, how much cash flow is at your disposal, and how long it should last you given your average monthly business expenses. Thanks to accounting software, chances are you won’t have to create a chart of accounts from scratch.