A slight increase or decrease in pricing can substantially impact the overall profit level, and overlooking this can lead to inaccurate forecasting. One of the most common errors in CVP analysis is the failure to consider fixed costs. Fixed costs are those that do not vary with the level of production or sales. These costs must be factored into the analysis since they significantly influence the break-even point and the level of profitability. To remain relevant and accurate, CVP analysis should be reviewed continuously.

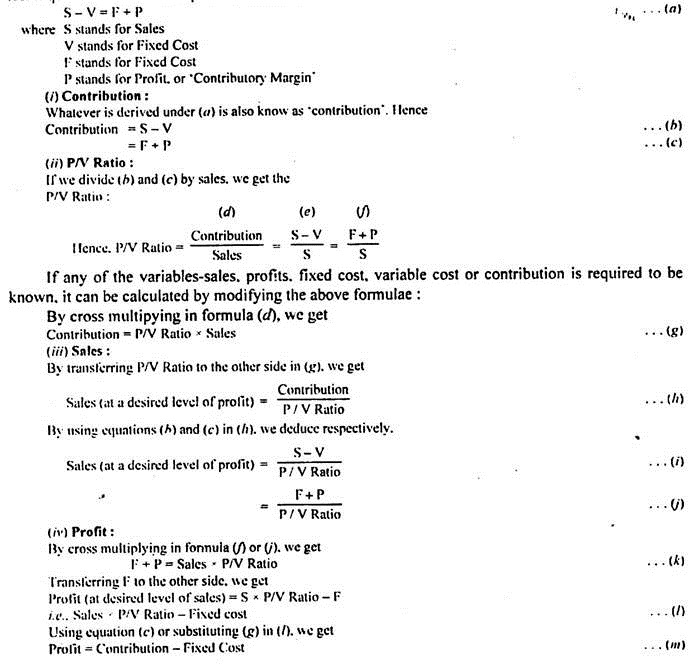

Formula

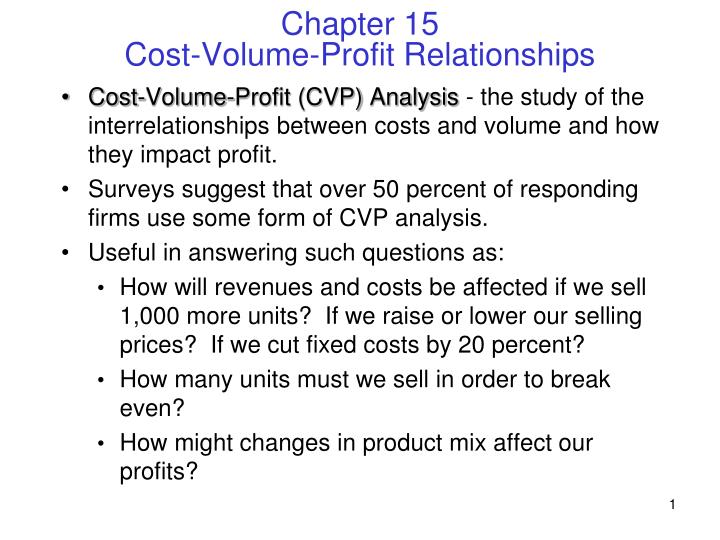

- It shows how operating profit is affected by changes in variable costs, fixed costs, selling price per unit and the sales mix of two or more products.

- It is assumed within this analysis that costs can be strictly categorized into fixed and variable costs.

- The company has a selling price of $10 per widget, and its variable costs are $5 per widget.

The primary purpose of CVP analysis is to provide insight into how changes in product price, sales volume, and variable costs will impact profitability. It’s the sum of both variable and fixed costs at a particular level of output. Total costs increase as production levels rise due to the variable costs, but the rate of increase becomes smaller due to the fixed cost spread over more units.

Best practices for effective cost volume profit analysis

At the heart of the CVP framework lie key components such as total variable costs, total fixed costs, contribution margin, break-even point, and profit thresholds. These elements collectively shape crucial facets of business decision-making, influencing strategies for sustainable growth and financial success. Total revenue is $ 120,000 for salesof 6,000 tapes ($ 20 per unit X 6,000 units sold). In the chart, wedemonstrate the effect of volume on revenue, costs, and net income,for a particular price, variable cost per unit, and fixed cost perperiod. Similarly, CVP analysis presumes that both variable and fixed costs behave linearly.

CVP analysis assumes constant selling prices and costs. – The Misconceptions of Cost-Volume-Profit Analysis

Moreover, companies can use CVP analysis on their various product lines by calculating the breakeven point for each product separately. By calculating the breakeven point for each product, companies can determine how many units they need to sell before earning profits. Cost-Volume-Profit (CVP) analysis is crucial for businesses seeking to optimize their revenue and cost planning. enrolled agents vs cpas The primary objective of CVP analysis is to examine the relationships between the variables that drive company profitability. CVP analysis assumes all costs, revenues, and profits are linearly proportional. This assumption fails to consider factors such as economies of scale or diseconomies of scale, where the unit cost declines or increases based on the production level.

Cost Volume Profit (CVP) Analysis

This is very similar to a break-even chart; the only difference being that instead of showing a fixed cost line, a variable cost line is shown instead. Compute the breakeven in units sold and sales dollars for Kinsley’s Koncepts. Follow the instructions to calculate the total contribution margin and the contribution margin per unit. Contribution margin is the amount by which revenue exceeds the variable costs of producing that revenue. The responsibility of interpreting the Cost-Volume-Profit (CVP) analysis in an organization falls on several individuals who hold critical positions in the company’s decision-making process.

A. Senior Management – Responsible for Interpreting the Cost-Volume-Profit Analysis

The graph can then be drawn (Figure 3), showing cumulative sales on the x axis and cumulative profit/loss on the y axis. It can be observed from the graph that, when the company sells its most profitable product first (X) it breaks even earlier than when it sells products in a constant mix. Hence, it is the difference between the variable cost line and the total cost line that represents fixed costs.

This represents the sales volume level where the contribution margin equals fixed costs, resulting in zero profits or losses. It is calculated by dividing total fixed costs by the contribution margin per unit. It represents the amount of income that is available to cover fixed costs and generate profits. In summary, the sales price is an important component of Cost-Volume-Profit (CVP) analysis. By understanding the impact of changes in sales price on contribution margin, break-even point, and profitability, businesses can make informed decisions about pricing that maximize profits.

These costs are incurred by a company regardless of whether it produces or sells anything. Examples of fixed costs include rent, salaries, property taxes, and insurance premiums. Break-even point is the level at which total revenue equals total costs, i.e. when a company or organization makes neither a profit nor loss.

Cost-volume-profit (CVP) analysis, also referred to as breakeven analysis, can be used to determine the breakeven point for different sales volumes and cost structures. The breakeven point is the number of units that need to be sold—or the amount of sales revenue that has to be generated—to cover the costs required to make the product. Fixed costs are not affected by changes in sales quantity within an organization’s relevant range of production. The landlord will not increase or decrease the monthly rent based on how many units Kinsley sells or produces in the space.

Fixed costs, as the term suggests, do not change with the level of production or sales. Businesses can optimize their operations and maximize profitability by understanding the relationships between fixed costs, variable costs, sales volume, and profits. With this knowledge, managers can also make more accurate forecasts and develop sound financial plans for the future of their company. Analyzing fixed costs is crucial in CVP analysis because it helps businesses determine the minimum level of sales volume needed to cover all fixed expenses.